Cashless & Contactless Rides: The Commuter Preference of 2025

For decades, cash ruled urban mobility. Commuters stepped into cabs with a mental checklist: Do I have enough cash? Will the driver return the right change? What if the POS machine is not working? But mobility in 2025 has outgrown those uncertainties. Today’s riders expect payments to be instant, invisible, and cash-free. And that expectation is shaping the future of every taxi booking app, cab booking app, and taxi business app in operation.

The shift isn’t driven by technology alone. It is driven by changing traveler psychology. Riders want speed, safety, and certainty -and they are choosing services that give them those benefits without friction. That explains why businesses running traditional taxi fleets are now turning toward white label taxi app platforms that enable a smart, secure, and contactless payment ecosystem out-of-the-box.

The conclusion is clear: In 2025, if a taxi operator isn’t offering cashless and contactless payments, riders will simply pick someone who does.

The New Standard in Urban Mobility Payments

Digital behavior has reached a tipping point. People have grown comfortable paying for daily services through online apps -from groceries and entertainment to public transport passes. Mobility is part of this same evolution. Riders today expect the convenience of a taxi ride app that completes the transaction automatically the moment a journey ends.

The rise of UPI, digital wallets, and contactless cards has made paying through phones more natural than carrying cash. Global commuters consistently say they prefer services that eliminate manual payment interactions altogether. What started as a safety preference during the pandemic has now become a global lifestyle habit.

Cashless rides give travelers psychological comfort:

The fare is settled. The receipt lands in the inbox. The journey ends without negotiation.

This trust and transparency is what keeps passengers loyal -and it is where online cab booking app solutions are winning the mobility market.

A New Competitive Advantage for Taxi Operators

Fleet owners aren’t simply adopting cashless payments because riders want them. There is a stronger business logic behind this shift.

When every fare goes through digital rails, taxi companies gain:

- Faster, more reliable revenue cycles

- Accurate financial tracking

- Reduced disputes and theft risks

- Stronger compliance for auditing and taxation

- Increased efficiency per driver per shift

Digital transactions aren’t just convenient; they improve utilization of assets on the road. Drivers finish more trips, have fewer delays, and no longer lose time sorting payments. Riders step out quicker. The entire flow of a taxi service becomes sharper.

This efficiency is why local operators -who once depended entirely on cash -are now choosing white-label platforms to upgrade their technology stack quickly, without high app development costs.

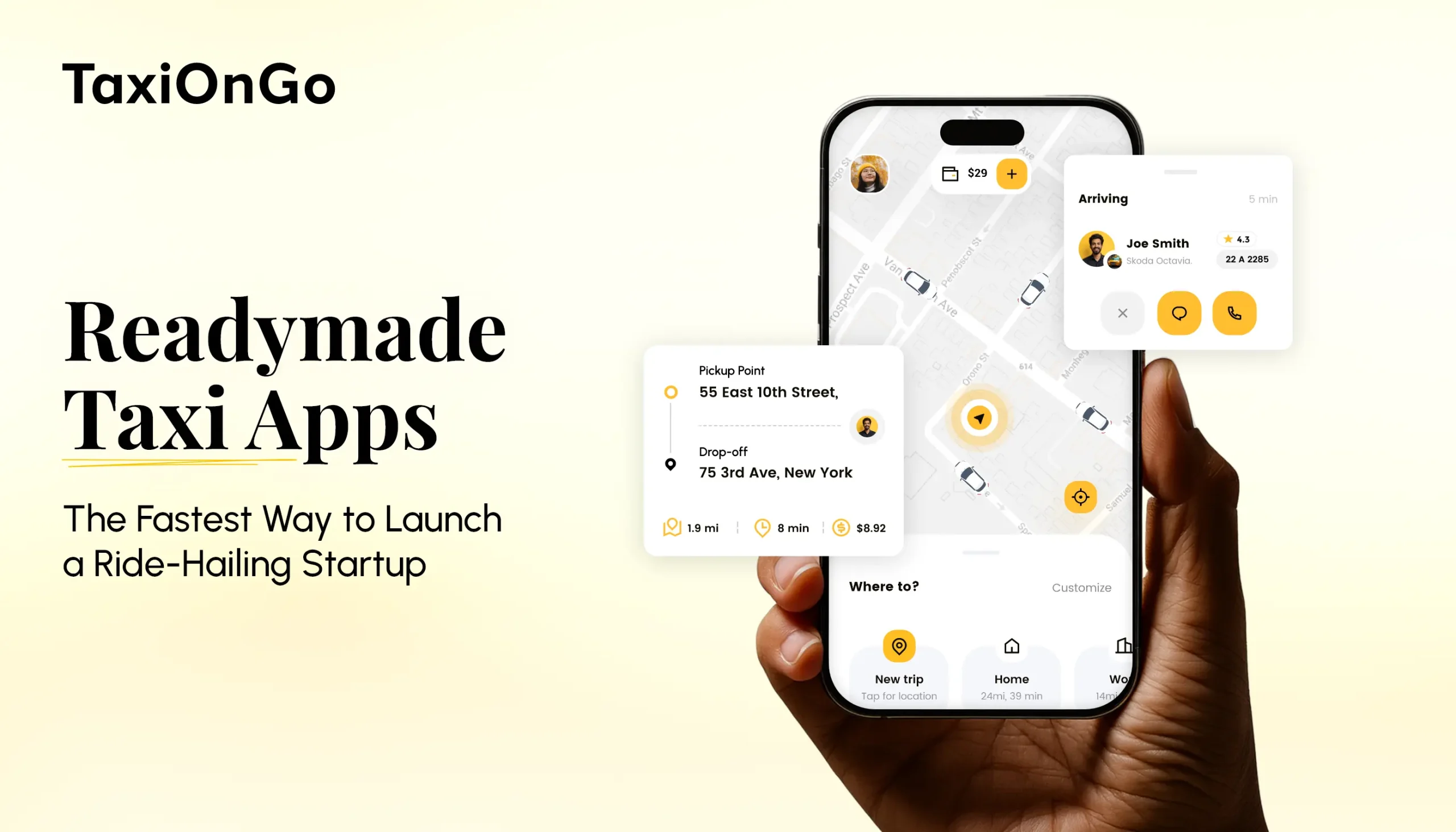

How White Label Taxi Apps Make Cashless Effortless

Developing a robust taxi booking app from scratch takes time, resources, and technical expertise that many taxi businesses don’t have. White label solutions solve that gap immediately.

They come equipped with everything required to offer a secure, seamless cashless ride experience:

- Rider and driver app with full branding

- Automated fare calculation and digital receipts

- Wallet, card, and online payment gateways

- Real-time tracking and ETA transparency

- Driver verification and safety monitoring

- Operation-wide financial analytics

Taxi operators bring the fleet, and the platform brings the innovation. This blend is empowering regional taxi leaders to compete with global ride-hailing giants using their own brand and their own business rules.

When riders pay without friction, loyalty shifts toward the local businesses that deliver that upgraded experience.

The Psychological Shift: Invisible Payments, Visible Comfort

Riders today don’t want to think about payments during or after a journey. Payments are expected to be as invisible as the engine under the hood -powering the ride, but unseen.

A taxi service app that enables contactless payments solves:

- The awkward “change problem”

- Safety concerns of carrying cash

- Accounting complexities for operators

- Payment refusal or fare negotiation issues

This transparency builds trust on both sides. Drivers know they’re being paid correctly. Riders know they are not overcharged. Confidence becomes the currency of retention.

With better trust comes better usage. And that directly translates into growth.

Security: The Backbone of Cashless Adoption

While convenience attracts riders, security keeps them using the app. Cashless taxi operations must rely on certified payment infrastructure, fraud detection, strong data encryption, and verified driver profiles. A poorly managed payment experience can destroy trust instantly.

Leading taxi business apps protect users by:

- Encrypting financial details from end-to-end

- Partnering with globally compliant gateways

- Offering clear refund and dispute channels

- Maintaining robust identity verification for drivers

This safety-first mindset is what will separate serious mobility businesses from the rest.

What Comes Next: Autonomous Payments in Mobility

We’re only at the beginning of the transformation. The next wave will make commuting even more effortless:

- Fares automatically deducted when the car stops

- Subscription mobility replacing per-ride payments

- Intelligent payments that apply discounts or credits automatically

- City-wide co-wallets that work across buses, metros, and taxis

- Spending insights that help riders manage budgets

For Gen Z and beyond, cash inside a taxi will feel as outdated as paper boarding passes at airports. Payment will move entirely to the background. The experience will take the spotlight.

Operators that adopt these systems today will be the category leaders of tomorrow.

The Road Ahead: Act Fast or Lose Ground

The message from 2025’s commuters is loud and clear:

Cashless is not optional anymore.

Contactless is not a premium feature.

Convenience is the reason riders stay -and the reason they leave.

Taxi operators who upgrade their offering with a white label taxi app are not just modernizing payment systems; they are safeguarding their business viability.

Mobility is a competitive landscape -and customers choose the smoothest path forward.

Conclusion

The world has changed how it travels. Riders want speed, safety, and transparency. Taxi businesses that remove friction from payments will experience measurable returns -higher bookings, improved customer satisfaction, better driver retention, and stronger financial governance.

Cashless and contactless rides are not merely a 2025 trend; they represent the new operating standard for mobility. The sooner taxi companies embrace this shift, the more confident they can be about the future of their business.

Because in the mobility industry of tomorrow, the winners will be the ones whose payments are never noticed -only appreciated.

Frequently Asked Question

Most taxi operators adopt a hybrid approach initially – offering cashless as default while keeping cash as a fallback during transition. Over time, data shows that cash usage naturally declines as riders experience faster and safer digital payments.

All earnings are automatically tracked in the driver account within the app. Payouts are settled on a defined schedule (daily, weekly or custom), which eliminates handling discrepancies and improves driver trust.

Modern taxi booking apps support offline-to-online continuity. The trip fare is stored securely and automatically processes once the network reconnects, preventing revenue loss or fare disputes.

While transaction fees exist, operators often see a net gain due to faster trip cycles, stronger fare compliance, reduced fraud & higher customer retention – all of which contribute to a meaningful revenue lift.

Payment gateways follow international compliance standards and use data encryption to secure card and wallet information. Businesses do not store raw payment data, minimizing security risks and simplifying regulatory responsibilities.

Recent Blogs

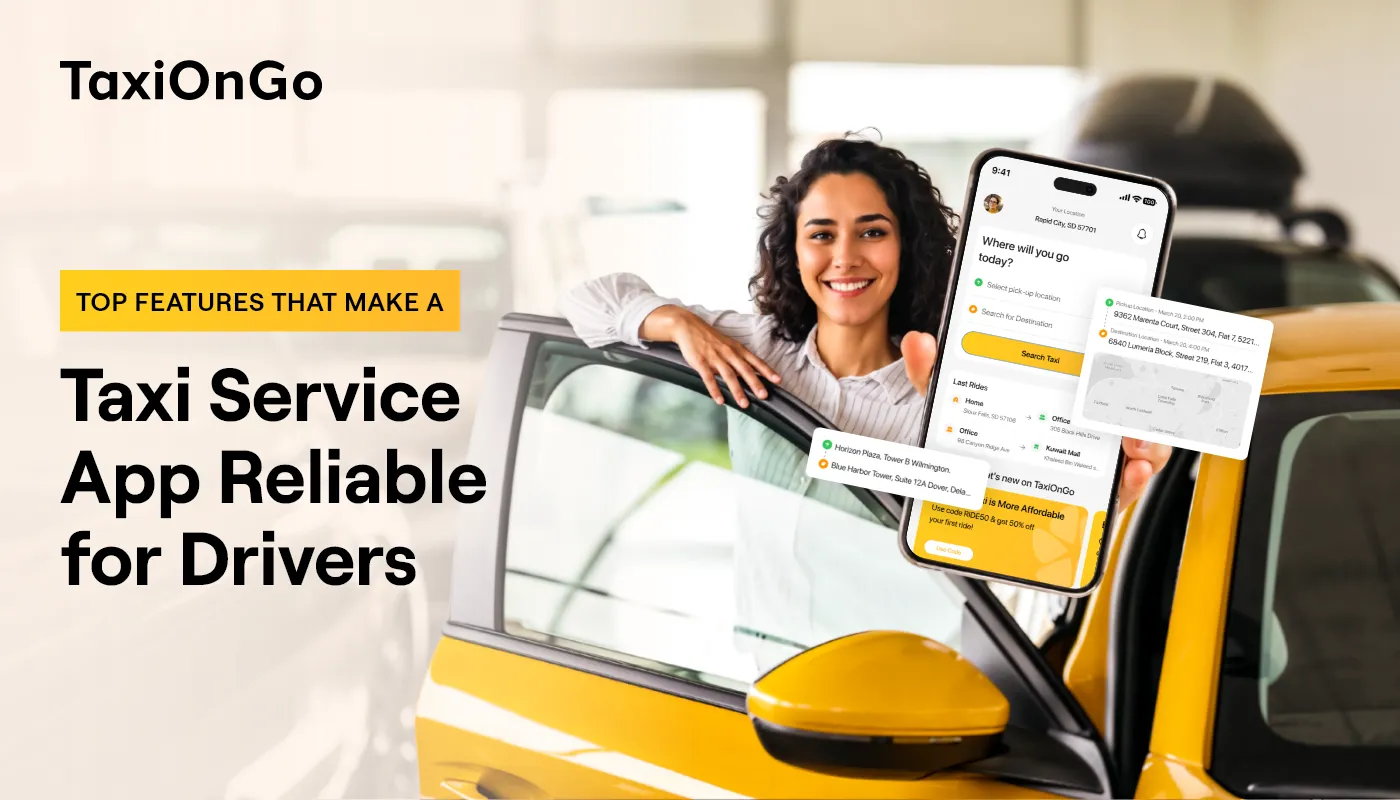

The ride-hailing industry is no longer dominated by just global giants. In 2026, the real growth is happening in local markets, niche segments, and region-specific mobility services. Cities are expanding, commuter behavior is changing, and customers increasingly prefer reliable, locally operated ride services over generic global platforms. For entrepreneurs and fleet owners, this shift presents […] Read more

A taxi business can grow only when its drivers are supported, empowered, and equipped with the right tools. Many companies focus on creating the best cab booking app for riders, but the real foundation of a successful taxi platform lies in delivering a smooth, stress-free experience for drivers. When drivers feel confident using the platform, […] Read more

In today’s mobility ecosystem, convenience defines customer loyalty. With ride hailing technology evolving rapidly, riders are no longer satisfied with just opening an app, tapping a few buttons & waiting for a cab. The expectation is now instant, hands-free & personalized booking experiences. This is where voice commands are transforming the future of ride-hailing platforms. […] Read more